Overview

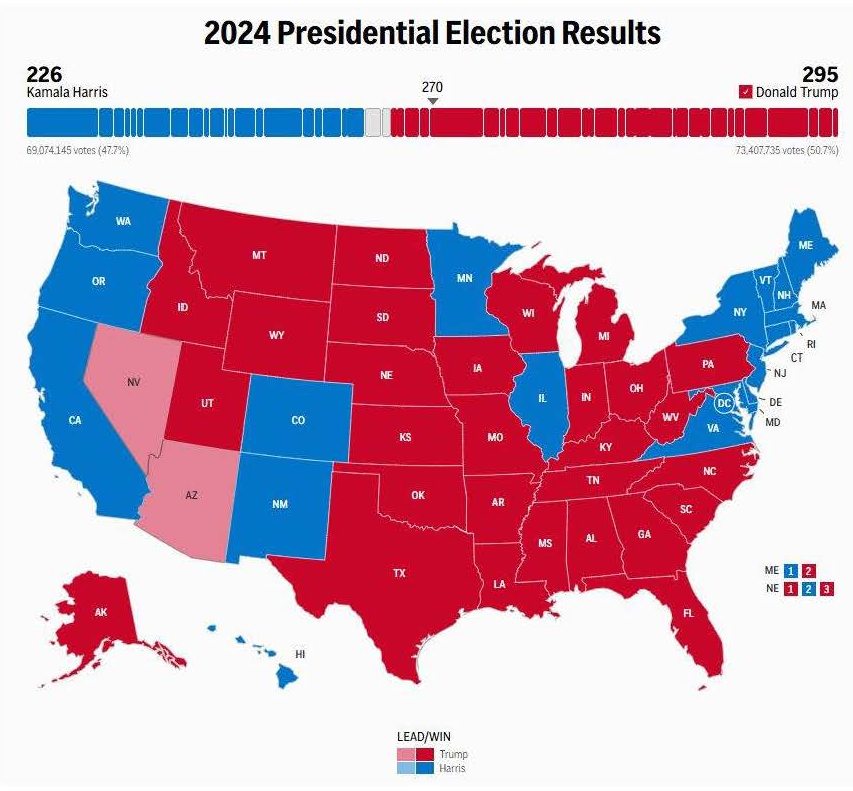

Donald Trump was elected the 47th President of the United States on Wednesday 6th November ensuring an unlikely political comeback after being voted out of office 3 years and 10 months prior.

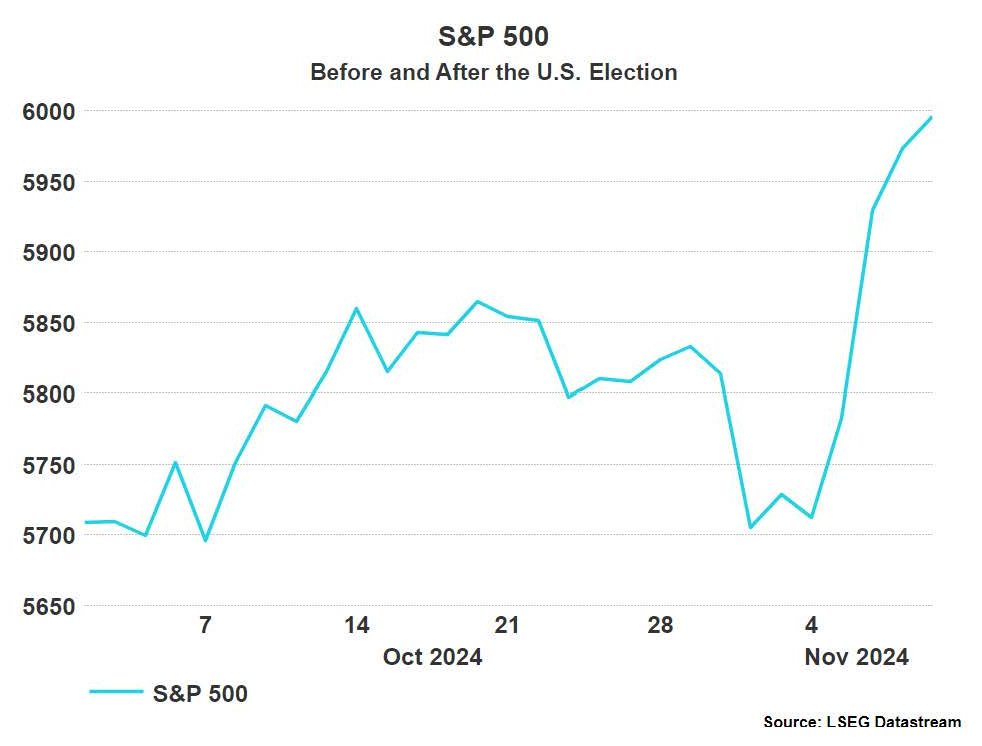

Following Donald Trump’s victory, the market, which has typically favoured the republican’s business friendly policies, has reacted positively with the S&P 500 up over 2.5% and the NASDAQ also rising almost 3%. The recent victories in the popular vote, Senate, White House, and potentially the House of Representatives have generated significant market excitement. However, it is crucial to recognise that markets can be inefficient and driven by emotions. It is important to maintain a long-term perspective. The economy continues to decelerate, lending itself to caution in managing investment portfolios.

Market reaction

Equity markets rose off the back of the news coming out of the White House. We can split up this positive reaction into several sections.

Equity markets rose off the back of the news coming out of the White House. We can split up this positive reaction into several sections.

Firstly, much of the performance seen following the election could be classified as a ‘relief rally’. As we know, one thing which markets do not like is uncertainty. Therefore, with the result now certain, some of the caution which may have been exhibited in markets leading up to the election is likely to have been lifted. Investors often prefer stability and predictability, and the election outcome provided a degree of clarity.

Additionally, out of the two candidates (Harris and Trump) a Trump victory is also favourable for markets for a number of reasons. It is no surprise that business tycoon Donald Trump has several policies which will benefit corporations and subsequently also the financial markets.

Perhaps the most prominent of all is the proposed tax reductions whereby corporates will pay less tax, thus improving their bottom line. Lower corporate taxes can lead to higher net profits, potentially leading to increased dividends for shareholders or more capital available for reinvestment in business operations and expansion.

His historical approach to deregulation suggests that sectors such as fossil fuels, energy, financials, defence, private assets and manufacturing could experience a more favourable operating environment. This might encourage expansion, job creation, and higher output, all of which could positively influence market sentiment and stock prices.

The positive effect on financial markets because of Trump’s pro-business attitude, in particular US equities, can be seen below.

During his previous presidency, equity markets outperformed the average. During his tenure, the stock market saw significant milestones, with major indices reaching record highs.

A more idiosyncratic result of the election was the likes of Tesla rising 14.75% because of the close relationship between Donald Trump and Elon Musk, leading investors to believe that Musk will be able to capitalise off a Trump victory. Although this is a specific case, it is an important to consider that the ripple effects of a change in presidency is not always so obvious and a lot of the initial reaction can often be emotional.

In terms of fixed income, the initial reaction to the presidential election was an uptick in bond yields. The 10-year yield, which moves inversely to the price, was last up 15.3 bps at 4.441%, resulting in the biggest one-day rise since April. Trump promoted tax cuts during his campaign, which economists believe will boost the economy but also increase budget deficits and government borrowing. He also advocated for tariffs, which analysts predict will drive up inflation and limit the Federal Reserve’s ability to lower interest rates.

As well as the election we also saw the US Federal Reserve cut rates by 25bps in the November meeting, signalling to markets a slower rate cutting cycle following the initial 50bps in September. The result of both these aspects is investors pricing in a greater likelihood of fewer cuts going forward. The FedWatch tool highlights the increased probability of 25bps of cuts in the next meeting and decreased probability of a further 50bps compared to prior the election.

Looking forward

Whilst we believe that Trump’s presidency will likely bode well for financial markets, we think it is important to not get carried away with the short-term exuberance which comes with this announcement.

Once the market settles down, we are likely to see the market re-price as it becomes clear which of Donald Trump’s proposed policies will come to fruition. We believe it is important to remain diversified in portfolios and not chase short term rallies in both sectors and locations off the back of news/data.

Using this approach is likely to benefit long-term returns by limiting aggressive drawdowns as a result of being over exposed to a particular area.